By Karl Davis

What does the Future of offshore wind look like? There are a number of market trends and new technologies that I believe will have an impact on the offshore wind industry and foundation design over the next decade.

A key question is how are we to adapt and evolve our designs to meet what has always been our biggest challenge – reducing the levelized cost of energy (LCOE) for offshore wind.

Expansion into new regions

Offshore wind is no longer niche and restricted to Europe. In 2019, China installed more capacity than any other country, and Taiwan, Japan, South Korea and Vietnam are all investing in developing OWF and their own supply chains, as are the USA and to a lesser extent Canada. Other countries like Brazil, Mexico, India, Sri Lanka and Australia and others are preparing the necessary systems, legislation and partnerships to take advantage of offshore wind in the near future. These new markets will drive technological advances because it will be a much bigger industry.

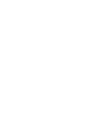

In countries such as the UK, Germany and China, where offshore wind is well established, many of the shallower sites have already been developed, and with 80% of the world’s offshore wind resource potential lying in waters deeper than 60m, there will be a drive to develop economical foundation designs for deeper waters.

Turbine sizes

Wind turbines continue to increase in size, furthering the economies of scale for offshore windfarms. The latest monster to be announced is Siemens Gamesa’s 14MW, which has a 222-metre rotor diameter and will be ready for serial production in 2024. Following close behind it are even bigger turbines from Vestas and GE, with a 20MW turbine starting to feel inevitable.

The greater size means greater weight and height, which has knock-on effects for the cost and complexity of foundation fabrication, transport and installation.

The question is, at what point will monopiles no longer be an option for these massive turbines? Will floating wind be more suitable and competitive as turbines get even bigger? Or will turbine size be limited by feasible foundation design? Also, would it be better for the cost of energy if the industry was to focus on producing cheaper turbines rather than bigger ones? In the end it will be about what is the most cost-efficient size for the full life cycle of the project, today this is one of the big unknowns for the industry.

Talk with a specialist

We've been a part of some of the worlds most exciting and

complicated projects in offshore wind.

If you need more eyes, brains and hands, we're ready to help.

The commercialisation of floating foundations

Floating offshore wind is predicted to reach commercialisation by 2030, by which stage it’s anticipated there will be 6GW installed globally. The current levelised cost of energy (LCOE) for floating wind can be 2 to 3 times that of the fixed wind because the CapEx costs are high. Although floating wind can’t currently compete with fixed foundations in depths below 80 to 100m, and the facilities for the serial production of floating

foundations is yet to be developed, there is currently a lot of investment and excitement around floating offshore wind.

Portugal, UK, France and Japan are leading the way in the floating wind development, while Norway, Denmark, the USA and South Korea are in close pursuit.

New players in the industry

As the shift to renewables gathers pace, there are likely to be more developers and suppliers with floating skills from the Oil and Gas industry around the world who could further accelerate the development of this foundation type. It is also likely smaller outfits in marine services take advantage of the very different opportunities that will come with the growth of floating wind and inject some competition and hopefully innovation into the offshore wind industry as a whole.

A shift to life extension

The offshore wind industry is starting to reach a point of maturity where a number of existing windfarms are approaching their original design lives. As the CAPEX of these assets should now have been well paid off, there will be a natural tendency to try and extend the life and eek out every last joule of energy. This will present some interesting new challenges to the industry, finding ways to safely operate aging infrastructure in arduous environments, or looking at re-powering existing sites.

AI and IoT

The offshore wind industry has embraced cutting-edge technologies such as Internet of Things, artificial intelligence, machine learning and blockchain to improve the efficiency of power generation, increase turbine reliability and reduce operation and maintenance costs. The advances made in these areas will continue to make offshore wind more competitive.

Hydrogen and other new energy technologies

The evolution of technologies such as hydrogen could make offshore wind more cost-effective, and increase the capacity for storing energy generated by offshore wind. Rather than the expensive electricity export cables that run on shore from wind farms, we could potentially deliver hydrogen onshore instead.

Given that it may be easier to fit hydrogen electrolysis systems on a floating wind systems than on a fixed one, this could possibly alter the demand and adoption of floating wind. How will this play out over the next few years?

The future of offshore wind is bright

One thing is for certain, and that is the next decade is not going to be boring. I, for one, am excited about the potential of the coming years and the recent change in tone from the new Biden administration in the US only adds to the sense of rapidly increased market momentum. The future is bright. The future is windy.

Karl

To find out more, please get in touch with the team at Empire Engineering.