Flipchart Friday

Contracts for Difference

By Louise Coles

The Contracts for Difference (CfD) scheme is a key mechanism in moving sustainably towards a green energy future. By guaranteeing fixed payments for electricity generators and shielding them from fluctuating market prices for electricity, the CfD scheme encourages investment into green energy production by derisking capital loss.

Let’s take a closer look at what Contracts for Difference are and how they work.

What is a Contract for Difference?

A Contract for Difference (CfD) is a long term (typically 15 year) contractual agreement between a low carbon electricity generator and the Low Carbon Contracts Company, known as the LCCC. The LCCC is government owned – and under the CfD agreement, the generator’s income per unit of electricity is fixed.

How does the Contract for Difference scheme work?

The Contract for Difference scheme has three key elements.

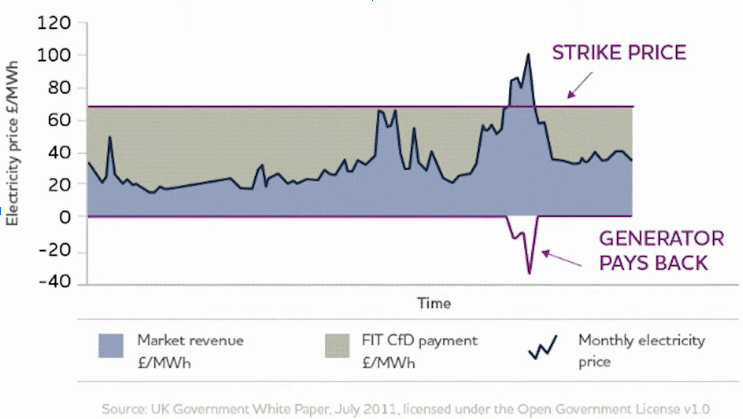

Strike price: This is the price the LCCC agrees to pay the energy generator. It’s set by an auction (more on that shortly) and varies from project to project. The strike price is fixed for the duration of the CfD agreement, although it is index linked with annual adjustments.

Market reference price: This is a measure of the market price for electricity. For ‘intermittent’ generators like offshore wind projects, which constitute most of the CfD portfolio, the reference price is set for each hour based on the results of auctions for power held the day ahead of generation. This is referred to as the Intermittent Market Reference Price (IMRP).

Difference payment: The difference payment is calculated by comparing the market reference price and the strike price. If the market reference price is below the strike price the LCCC pays the generator a top up to cover the difference. When the market reference price is above the market reference price, the generator pays the difference back into the scheme – helping to protect consumers from high prices.

The LCCC sets a levy on energy suppliers, which funds the payments to energy generators. Hence the scheme is ultimately funded by consumers. As a private law contract, the CfD cannot be unilaterally changed once signed.

How does the auction process work?

CfD agreements are awarded via auction. The Department for Business, Energy and Industrial Strategy (BEIS) sets the overall policy and parameters of the auctions – such as the maximum strike price and energy production capacity. National Grid ESO runs the auction, and the LCCC then signs contracts with the winners.

Production sites are auctioned off and commissioned during Allocation Rounds (ARs), during which generators submit sealed bids containing the minimum strike price they will work with, their production capacity and other required parameters. Bids cannot be higher than the administrative strike price set by BEIS. National Grid ESO then ranks the bids by price for each technology pot and delivery year until either the capacity cap, budget cap or minima/maxima (if used) is reached.

The auction winners then have a number of milestones to meet within the first few years of the contract in order to preserve the terms for strike payments. These include proving commitment to the project within 12 months of signing the contract and commissioning 80% of the initial capacity estimate within the target commissioning window. Projects that exceed the cap are unsuccessful.

Allocation Round 5 vs Allocation Round 6

Offshore wind developers have long been voicing concerns that the maximum strike price being offered by the LCCC has been too low to make site development financially viable. This was made manifest when Allocation Round 5 (AR5) resulted in zero bids from developers for available offshore wind production sites.

As a result, for AR6 (opening in March 2024) the BEIS has raised the maximum strike price. Fixed bottom offshore wind payments have increased by 66%, from £44/MWh to £73/MWh. Floating offshore wind payments have increased by 52% – from £116/MWh to £176/MWh.

What are the benefits of winning a Contract for Difference at auction?

Contracts for Difference provide long term revenue certainty for new power projects, which reduces risk for investors. The revenue that’s guaranteed through the strike price mechanism provides the basis for low-cost financing of capital-intensive projects – such as offshore wind development. Reduced capital risk enables projects to be built at a lower overall cost and makes them more attractive to a wider pool of investors. There is also the removal of a counterparty risk as the counterparty that pays the generator the money is the LCCC – backed by the UK government.

Like to know more about Empire Engineering?

We exist to streamline the development of offshore wind energy projects. Here’s how.

Talk with a specialist

If you have any questions or want to know about working with Empire Engineering, get in touch.

Empire specialists can effectively and efficiently assist with your offshore wind project. To find out more, please get in touch with the team at Empire Engineering.